Chargeback is one of the worst words for merchants today. While they are a huge pain, chargebacks are a part of any business that accepts debit and credit cards. Originally chargebacks were used to protect consumers from charges made fraudulently, along with keeping merchants accountable and honest. However, today chargebacks are used by many more people and can feel like a vendetta.

What is Debit Card Chargeback?

Like a credit card chargeback, a chargeback from a debit card is a reversal of the transferred funds. A chargeback requires the consumer to directly contact their bank. Their bank then contacts your bank, and the money is returned to the consumer.

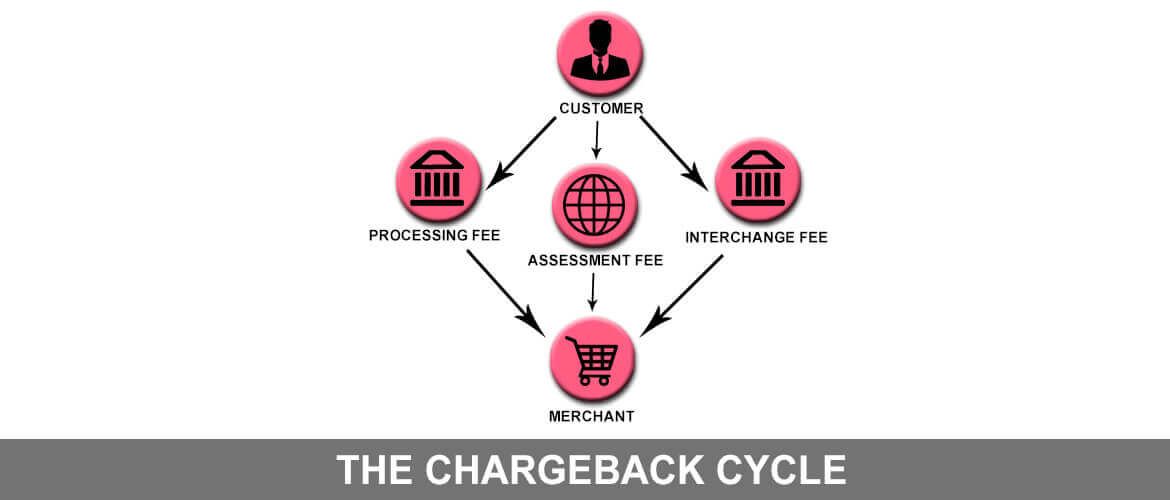

The Chargeback Cycle

To start a chargeback a customer has to go to their bank, and file their dispute against any transaction that is false or they were not provided service for. Their bank or the issuing bank will issue them a temporary credit for the amount of the transactions.

The issuing bank then informs the credit card company about the chargeback. The credit card looks into the transactions and contacts the business’s bank. The business’s bank contacts the processing company, which removes the money from the business’s bank account. The business is then contacted about the chargeback. At this point, there is the choice to just allow the chargeback to take place, or you can fight the chargeback.

Chargeback Cycle

You can fight chargebacks. However, as originally chargebacks were designed to protect consumers, you will need to provide proof that you are in the right. The problem is even if you win all the cases of chargebacks, having too many will harm your business’s reputation. This causes your account to be frozen, or your whole account to be terminated. There can also be criminal charges and investigations done. Along with those, there are also huge chargeback fees that are debited from your account if you lose the fight or choose not to fight chargebacks. The best thing that a business can do is to avoid chargebacks in the first place.

To fight a chargeback, a business’s needs to fill out paperwork and provide proof of the transaction to the issuing bank. The issuing bank will contact the credit card company, for more information about the transaction. After the issuing bank has all the information about the transaction, they look all the documentation and make a decision. This could take just a few days to a few months depending on the credit card company, as some have delays in their sending of information. If the chargeback is found to be wrongful, the money is given back to the business, and the temporary credit is taking away from the customers. If the document is rejected, the temporary credit turns into permanent funds.

Avoiding Chargebacks

The simplest solution to not having chargebacks is to not accept debit and credit cards. However, in today’s modern world you have to accept debit and credit cards. At the same time, there are some things that you can do to limit the amount of chargebacks you receive.

The first is to have a refund policy that is easy to understand. Unhappy customers just want their money back. Having a refund policy makes it easy to do this. Chargebacks take time, and most consumers would prefer just walk in and get their money.

The second is to always check the signature and the card. Having a customer sign a receipt is a pain, but it helps you fight chargebacks. You should also make sure that the card is signed and not expired. If the card in not signed or is expired, do not accept it. The reason for this is that expired cards could pay for the item, and then charge you later.

Lastly, you should have clear records of everything. There are bad people who file chargebacks to get free things. Having and keeping all the records, you can fight chargebacks and prove that they got the item. Your receipts need be legible and complete. This is important because if they can be understood clearly by consumers, this is valid proof that the chargeback is not valid. You should save these receipts for 3 years, as some providers allow for that long of a time period.

![]()

Email us anytime!

Email customer service 24/7

![]()

Call us anytime!

Reach customer care 24/7 at +1 (888) 901-8653